This is your TSP Watchdog UPDATE for the week ended November 16, 2018.

Stocks sold off hard this week – with large losses early in the week partially offset by a bounce on Thu and Fri. At the closing bell on Fri, the S &P 500 was down 1.61% for the week, the Dow was down 2.21% and the NASDAQ was down 2.15%.

Investors have been worrying for some time about when the current bull market will roll over to a correction, or even a bear market. They have been especially worried about the tremendous surge in technology shares – headlined by the emblematic FAANG stocks: Facebook, Amazon, Apple, Netflix and Google. So, when a handful of companies that make component parts for Apple iPhones reported weak results in recent days, traders and investors viewed it as a warning that Apple was slowing – and extrapolated this to mean other tech companies would also encounter slowing growth.

Technology stocks have led the market’s surge over the last two years, and a slowdown there – especially against the backdrop of rising interest rates, slowing global economic growth and a market that is long overdue for a significant correction – was more than stocks could handle. At the risk of using an untimely analogy, we call that a spark in a tinderbox – worried investors with news that plays on their biggest concerns – and, voila…the Dow was down 602 points on Mon.

As if on cue, comments from multiple regional Federal Reserve presidents about re-thinking the current policy for raising interest rates (as in “maybe we shouldn’t raise rates further without considering the rising tide of slowing global economic growth”) propped up markets late in the week, and stocks recouped more than 1/3 of their losses. Investors love low interest rates, and a “fix” in the form of hope that rates will not continue to rise (at least not as fast as expected), was enough to stop the bleeding and generate some buying at the end of the week.

In our TSP Watchdog database, nothing changed – except that the C fund fell more convincingly below its trend line. Remember that last week, it was hovering just barely below its trend line. With the selling this week, it is now firmly below its trend line.

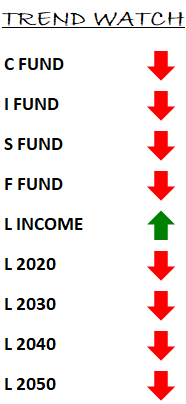

All the primary TSP funds remain on negative trends (C fund, S fund, I fund and F fund). In our process, we recommend avoiding funds that are on negative trends – meaning moving out of them via inter-fund transfers to the G fund and discontinuing new contributions to them (and contributing, instead, to the G fund).

With all primary funds on negative trends, we are 100% in the G fund right now – both for current holdings and for new contributions.

We do track the trend of the L funds for those of you who use them, and only the L Income fund is on a positive trend – due to its large G fund component (note: the G fund is ALWAYS on a positive trend). All the other L funds are on negative trends.

Our primary objective is protecting you from significant declines. With all the funds on negative trends, we see more potential for trouble than for gains. In this environment, we advise staying on the sidelines.

We liken negative trends to a football game when the other team has the ball, and we put our defense on the field to keep them from scoring. We are not focusing on scoring ourselves as much as we are focused on keeping them from scoring. When we get the ball back – when the trends turn positive again – we will shift our focus to scoring points ourselves (in the form of going back into the market and looking to make money).

For now, we are playing defense – looking to avoid losing money. We will look to make money when trends turn positive again.

Of course, please forward any questions you have by replying to this email. We are here to help any way we can.

HAPPY THANKSGIVING TO EVERYONE! May your heart be as full of gratitude as your plate is with turkey – every day, not just this particular Thursday in November.

Scot B.