This is your TSP Watchdog UPDATE for the week ended August 16, 2019.

Stocks fell for the third week in a row – with the S&P 500 losing 1.03%, the Dow declining 1.53% and the NASDAQ sliding 0.79%.

Since reaching all-time highs recently, the S&P 500 is off 4.6%, the Dow is down 5.5% and the NASDAQ has slipped 5.2%.

We saw extreme volatility during the week, including the worst day of 2019 on Wed. The Dow recorded the following daily point losses and gains:

Mon -391

Tue +383

Wed -800

Thu +100

Fri +307

[all market data from the Wall Street Journal Online Edition]

If you did not notice the volatility during the week, and just saw the final, moderate results, you might think “no big deal”. But this kind of volatility is rare in the context of an overall rising market. It is much more consistent with a declining market. Keep that in mind.

The news driving the selling during the week was more of the same: fears about trade with China, tensions in Hong Kong and interest rate activity – more specifically, the inversion of the yield curve.

Interest rates briefly “inverted” during the week – sounding an alarm about recession. This is a phenomenon of short term interest rates being higher than long term rates – most notably, the 2-year treasury paying a higher rate than the 10-year treasury (which is what happened for a short time on Wed). Normally, short term rates are lower than long term rates (think, lower interest rate on a 1-year CD compared to a 5-year CD, or lower rates on a 15-year mortgage than on a 30-year mortgage). That is the way it is most of the time.

But, when people get scared about “risk assets” (stocks) and/or interest rates in other countries get really low (many countries are paying NEGATIVE interest rates on their government bonds these days), it brings in lots of investors and capital to our treasury bond markets – which pushes interest rates down. And there is more pressure on the longer term rates than the shorter term rates – so those rates fall faster. When the long-term rates fall below the short-term rates (say, the 10-year rate falls below the 2-year rate), that is in inverted yield curve.

And the problem with an inverted yield curve is that it has been a reliable indicator of a recession 12-18 months in the future. Not perfect, but pretty reliable. So, investors get scared about recession when the yield curve inverts.

On the positive side of the coin, retail sales reports for July were better than expected. Given that retail activity is about 70% of our economy, this demonstrates current strength in the economy. But, the inverted yield curve casts a shadow on things going forward…

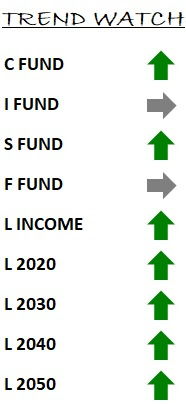

In our TSP Watchdog database, we saw all the growth funds decline – C fund, S fund and I fund (as well as the L funds that hold healthy pieces of these funds). The F fund continued to rally – but still not quite enough to reverse to a positive trend.

The C fund and S fund remain just bit above their positive trend lines. The I fund, though, has fallen right down to its trend line. Any further decline in the I fund will almost certainly trigger a negative trend.

In our system, a negative trend is reason to SELL/AVOID a fund. If we get a trend change in the I fund (or any fund, for that matter), we will alert you to the change so you can take the action you deem most appropriate in your TSP.

With no actual trend changes yet (it’s close, but nothing yet), we do not have any recommendation changes to report. But we are watching very closely these days as volatility increases and prices have fallen. If/when we get trend changes, we will alert you.

Of course, if you have any questions, please feel encouraged to reply to this email. We are here to help any way we can.

Scot B.