This is your TSP Watchdog UPDATE for the week ended May 1, 2020.

Stocks declined modestly during the week – S&P 500 -0.21%, Dow -0.22%, NASDAQ -0.34% – though these small losses do not tell the whole story. (all market data from Yahoo! Finance)

Through Wed, the Dow had gained more than 850 points – largely on hopes that states would begin reopening soon and a return to some sense of normalcy would follow. But Thu and Fri saw the markets shed all these gains, plus a little, as earnings reports disappointed and the realization that recovering from COVID-19 lockdowns would take a long time.

It is also worth noting that markets showed signs of tiring after staging a strong rally off the lows hit in late March.

The optimism of looking for a quick economic recovery is running into multiple reality checks:

- They are beginning to see that the damage to the economy is too great for a quick bounce back (a “V-shaped” recovery)

- Stocks were expensive before nationwide lockdowns cut the economy in half (almost) so it is difficult to justify stock prices anywhere close to previous (expensive) levels

- Historically, the combination of a bear market (20%+ market decline, which we have seen) and recession (which we are in) involves multiple waves of selling – not a single wave followed by a quick recovery

- The month-long rally topped Wed at a common retracement resistance level (it had recovered 61.8% of its losses) – and pulled back sharply from this level. Market novices often find it hard to believe how consistently patterns play out in the market, but this 61.8% recovery level is a very common level for recoveries to run out of steam. Voila!

- Some disappointing earnings reports – most notably from Amazon – highlighted the challenge presented by the COVID-19 lockdowns.

The bottom line is that the economy has been kicked in the teeth, and it is going to take a long time for it to recover. You do not put 30 million people back to work overnight – especially when many of them are afraid to leave their homes and many others are receiving more from unemployment benefits than they were bringing home in their paychecks.

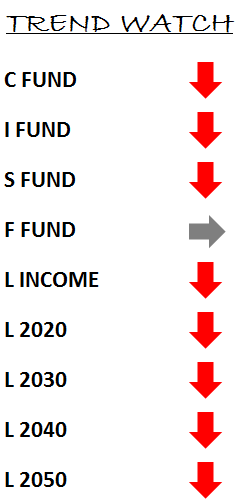

In our TSP Watchdog database, we have no trend changes this week. The market’s started the week strong, and it appeared like we might approach some trend reversals, but the rally fizzled, and we ended the week with all our trends unchanged.

Without any trend changes to direct us back into the TSP funds, we remain 100% in the G fund – a safe place to ride out the storm.

We will remain in this posture until trends reverse back to positive.

We rely on the trends to help us cut through all the noise that accompanies market drama. Our trend analysis guided us to move 100% to the G fund back on Mar 2, and we have remained there ever since – avoiding the ensuing volatility.

Believe me – we would rather be fully invested in the C, S and I funds. These funds are the money makers in the TSP. But today, they are all on negative trends so we view them as too risky. Yes, the markets have rallied sharply off their recent lows, but until the trends turn positive again we see these gains as fleeting and too risky to participate in.

From both a fundamental and technical standpoint, the market is facing daunting circumstances. Making money from here is an up-hill battle. We are not inclined to jump back into the market until the odds are better stacked to our favor. We prefer to protect our capital – sitting safely in the G fund until the trends turn positive again.

As always, please feel encouraged to reply to this email with any questions. Especially during tough times like this, we are here to help any way we can.

Scot B.