This is your TSP Watchdog UPDATE for the week ended December 14, 2018.

Stocks declined this week – the fourth time in five weeks. The S&P 500 lost 1.26%. The Dow dropped 1.18%. The NASDAQ slipped 0.84%.

All three indexes are now in “correction” territory – defined as a 10% decline from recent highs. This is the first time all three indexes have been in correction mode at the same time since Mar 2016. Also, all three indexes are down 5.5%, or more, this month – the worst start in December since 1980.

While economic numbers continue to come in fairly strong, investors are still worried about the same slate of issues we’ve been talking about for several weeks: slowing global growth (with disappointing reports out of China and Europe this week), future interest rate hikes from the Federal Reserve, declining expectations for corporate earnings and trade wars (especially with China). And, while Wall Street doesn’t pay a lot of attention to the side show in Washington, the Mueller investigation certainly isn’t helping the market.

As we have said many times, the volatility we are seeing is consistent with a declining market. The “official” pronouncement that all three indexes are in correction mode is consistent with our view.

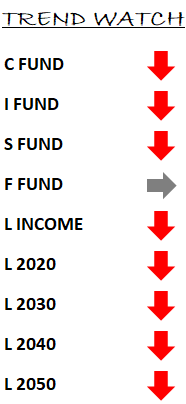

In our TSP Watchdog database, all the primary funds (C fund, S fund, I fund and F fund) remain on negative trends. Again this week, the F fund is close to reversing back onto a positive trend as investors seek out the relative safety of the bond market with the proceeds of their stock sales, but it still has not been quite enough to generate a BUY signal in the F fund.

The growth funds – C fund, S fund and I fund – fell further below their trend lines for the second week in a row.

We continue to avoid all the funds – with a 100% allocation to the G fund. We will stay in this posture as long as trends remain negative. Believe me when I say, we would much prefer to be invested – but we will not try to force anything. As long as the markets are troubled, and the risk of loss is greater than the potential for gain, we will remain defensive on the sidelines.

Obviously, this is not a posture that gives us much chance to make money, but that is because the market is not behaving in a way that offers much opportunity to profit. In fact, to the contrary, the market is in a mode that will gladly take our money – if we let it. We’ll stay out of harm’s way in the G fund until things change.

If you have any questions about the market, the TSP or your own TSP account, please feel encouraged to reply to this email and fire away. We are here to help any way we can.

Scot B.

P.S. Next week’s update will come on Christmas Eve day, and many of you may not be paying as close attention as usual. So, I want to wish you all a Merry Christmas, or, if you do not celebrate Christmas, the best of the season.